Published: February 16, 2026

In the last volume, I discussed fabless semiconductor companies that specialize in design. In this volume, I will discuss the historical background of the emergence of foundries that specialize in front-end manufacturing.

Table of Contents

About the Term Foundry

Advocate for Separation of Design from Manufacturing

Emergence of Foundries

Current State of Foundry Industry

Volume 15: History of Horizontal Specialization in the Semiconductor Industry–Emergence of Foundries

About the Term Foundry

When you look up the meaning of foundry in an English dictionary, you only find definitions such as casting, cast products, a place where metal is cast, or a metal casting factory. How did it come to be used in semiconductors? It is a mystery. Who was the first to use it?

Last time, I mentioned that Professor Mead of Caltech and Ms. Conway of Xerox received the 1981 Electronics magazine Achievement Award. In an article introducing their achievements (published in the October 20, 1981 issue of Electronics), the following statement appeared:

“The term silicon foundry was coined by Intel’s Moore, but Mead disseminated it.”

In the last volume I mentioned that Professor Mead was a consultant to Gordon Moore and Robert Noyce, the founders of Intel, and it’s a possible story when they are in that kind of relationship.

As you probably know, cast metal is a metal product made by pouring hot, molten, liquid metal into a form (called a mold), cooling it to harden it, and then removing it from the mold. Given a mold, any number of metal products can be made with the same shape as the mold. The process of making metal cast products is called casting, and casting is a metalworking process suitable for the mass production of metal products. In the case of semiconductors, if a photomask with a circuit pattern is available, it can be transferred to a silicon wafer in the manner described in the second volume. By repeating this process, any number of silicon wafers can be produced with many integrated circuit chips on which the same circuit pattern as the photomask is transferred. Because of the similarity between the two, corresponding to the mold of casting and the mask of an integrated circuit, it is assumed that the addition of “silicon” in front of “foundry” led to the term “silicon foundry.” In fact, it is often referred to simply as a “foundry” without “silicon” in front of that.

Hot molten metal poured into molds at foundry

Hot molten metal poured into molds at foundry

In some cases, the term “foundry” refers to companies that specialize in the contract manufacturing of front-end process of semiconductor devices, while in other cases it refers to the business of contract manufacturing of front-end process.

In the last volume, I mentioned that integrated device manufacturers (IDMs) initially contracted manufacturing fabless products, and it is still common for IDMs to have a foundry business as well. We offer foundry services as well. Please see the following link for details.

Foundry Service | Nisshinbo Micro Devices (nisshinbo-microdevices.co.jp)

In contrast, a company that is only involved in the foundry business is sometimes referred to as a pure-play foundry or a dedicated foundry.

Note: If you search for “foundry” on the Internet, you may find that it means a semiconductor manufacturing factory. However, an IDM manufacturing factory is never called a foundry.

Advocate for Separation of Design from Manufacturing

Professor Mead advocated the separation of semiconductor design and manufacturing in 1979. The following statement appeared in the following article:

“The concepts of silicon foundries and fabless design houses, and the separation of design from manufacturing were publicly introduced by Carver Mead in January 1979 at the first Caltech Conference on VLSI:”

(excerpt truncated)

Source:

Marco Casale-Rossi, “The Heritage of Mead & Conway: What Has Remained the Same, What Has Changed, What Was Missed, and What Lies Ahead [point of view],” in Proceedings of the IEEE, vol. 102, no. 2, pp. 114-119, Feb. 2014

Although separation and specialization are not the same, at least separation was more essential and important, since specialization is impossible without separation. As long as separation is possible, specialization is possible.

Since the systems were originally designed by users of semiconductors, and since semiconductors are no longer general-purpose components and have reached a level that allows systems to be integrated, I think it is right that the design should not be confined to individual semiconductor companies. Rather, it should be separated and opened up to users.

Openness allows users to design their own semiconductor devices. As mentioned in two volumes ago, Volume 13, such cases are increasing in large IT companies. A design company becomes a fabless semiconductor company if it develops and sells a general-purpose semiconductor device using its technology to a system company. Students and researchers can also design their own dedicated semiconductor devices for education and research.

Note: Since he advocated the separation of design from manufacturing, this could be seen as a prediction of horizontal specialization. However, it was unclear from my research whether he envisioned a pure-play foundry.

Emergence of Foundries

As I mentioned in the previous volume, fabless semiconductor companies emerged in the U.S. in the 1980s, but no foundry specializing in contract manufacturing was born in the U.S. at that time. IDMs in Japan, including our company (the semiconductor division of Ricoh Company, Ltd., which was the predecessor of the former Ricoh Electronic Devices), contracted manufacturing products for U.S. fabless companies, but at that time there were also no pure-play foundries in Japan. At that time, the business was small enough that it could be handled using IDMs' available production capacity. It was considered a one-time, side, or niche business for IDMs.

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s first pure-play foundry, was born out of Taiwan's semiconductor industry development policy. Taiwan was a latecomer to the semiconductor industry. Foundries did not emerge spontaneously in the process of industrial development. However, the Taiwanese government did not plan to create a company that would specialize in front-end contract manufacturing. The idea came from Morris Chang, TSMC’s well-known founder.

The historical background can be summarized as follows, based on various information obtained from internet searches.

Since the mid-1970s, the government of Taiwan has aimed to foster high-tech industries as a national policy. In 1973, the government established the Industrial Technology Research Institute (ITRI), which played an important role in promoting these industries. The government created a development plan for the electronics industry, and in 1974, the Electronics Research and Service Organization (ERSO) was formed in the ITRI. The development of the semiconductor industry was centered on ERSO. In 1980, United Microelectronics Corporation (UMC) was successfully spun off as an independent semiconductor company. UMC is now a foundry; at that time, however, it was an IDM.

Note: ERSO: Originally the Electronics Industrial Research Center, it was renamed the Electronics Research and Service Organization (ERSO) in 1979.

The government further decided to promote the VLSI program as the next step. In 1985, they invited Morris Chang, the former vice president of TI’s semiconductor business, from the U.S. to serve as president of the ITRI. In response to the government’s request for a business plan, Morris Chang proposed establishing a company that would specialize in front-end manufacturing, or foundries. The proposal was accepted and TSMC, a semi-private foundry company, was established in 1987.

However, finding private investors was difficult. All of the leading companies in Japan and the U.S. refused to invest, and only Philips in Europe agreed to invest in the company, enabling the company to be established. At the time, almost no semiconductor company believed that this business model would be successful and worth investing in.

Night view of Taipei, the capital of Taiwan, with its modern skyscrapers

Night view of Taipei, the capital of Taiwan, with its modern skyscrapers

In a 2007 interview, Morris Chang discussed how he came up with the idea of a pure-play foundry, making three key points.

First, he was familiar with the concept of separating design and manufacturing because he had read Professor Mead’s works, which were discussed in the previous and current volumes, while he was in the United States. Second, based on his 30 years of experience in the U.S. semiconductor industry, he knew how difficult it would be for a new Taiwanese company to break into such a competitive field dominated by powerful players. Third, the only possible strength of Taiwan’s semiconductor industry was thought to be manufacturing.

These three factors seem to have led him to the idea of a pure-play foundry. However, according to the article, he did not believe there was a market for foundry at the time. This was normal for the semiconductor industry at the time; as mentioned above, most major semiconductor companies refused to invest in TSMC. On the other hand, during his time in the U.S., he knew designers who wanted to become independent but gave up because they could not raise the money needed to build a factory. He recognized TSMC's potential to solve this problem and create a market.

See below for details on the interview with Morris Chan.

The interview conducted on August 24, 2007, available on the SEMI and Computer History Museum websites

Oral History Interview: Morris Chang | SEMI

Oral history of Morris Chang, PDF (2007, Computer History Museum)

For the first few years, the company took on fabless orders in Taiwan and the U.S. However, the business was still small-scale, and contract manufacturing of IDM’s products was the main business. These were the products that IDM’s factories were overflowing and could not produce. At this point, it would be reasonable to say that the situation of the company was as a subcontractor to IDM.

In the 1990s, however, the contract manufacturing business for fabless products seems to have really taken off. Following TSMC’s success, UMC, which had been an IDM, converted to a foundry and spun off its design division as fabless companies in 1995. One of these fabless companies is Media Tek, which was mentioned two volumes ago.

In 1994, an international association called the Fabless Semiconductor Association (FSA) was formed. It appears to have started with about 40 members, consisting of fabless semiconductor companies and foundries.

By the mid-1990s, fabless semiconductor companies had been in full swing, and the foundry business grew alongside them. In the late 1990s, our company (the semiconductor division of Ricoh Company, Ltd., which was the predecessor of the former Ricoh Electronic Devices) also began working with foundries for products using advanced logic processes.

Note: In 2007, the FSA was reorganized into the Global Semiconductor Alliance (GSA), a semiconductor-wide industry association that includes IDMs.

As mentioned above, foundries did not result from industry maturation or evolution. On the contrary, I think the idea emerged because Taiwan’s semiconductor industry was both late and underdeveloped.

At the time when TSMC was founded, the scale of the fabless business appeared small and could be handled on the sidelines of the IDMs. If TSMC had not existed, would someone has created a pure-play foundry when the fabless business grew to the point where it could no longer be managed as IDM’s sideline business? It is hard to say.

Current State of Foundry Industry

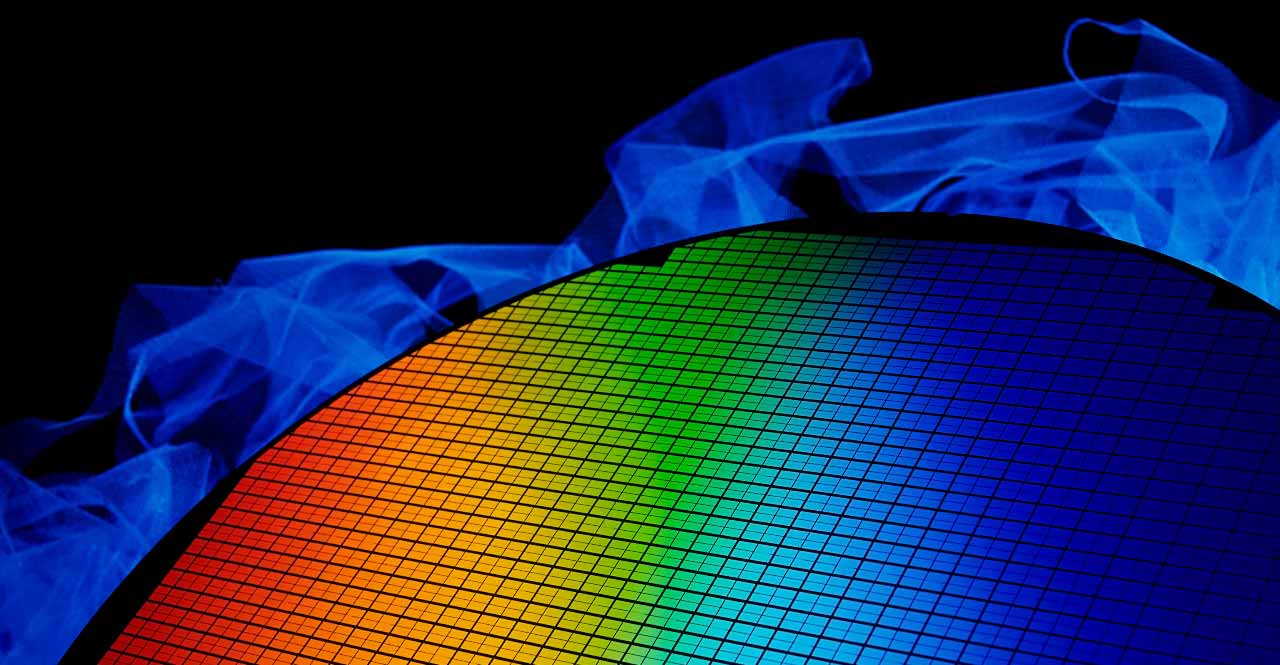

Based on data from TrendForce, a research firm that publishes quarterly revenue rankings, let’s take a look at the current state of the foundry industry.

Note: The content of this section is based on the 2022 fourth quarter (4Q) ranking data. However, comments based on the 2024 fourth-quarter ranking data are included in parentheses at the end of each paragraph.

As of the end of 2022, the top 10 companies in the revenue ranking held for more than 95% of the market share. The top five companies accounted for about 90% of the market, while companies ranked sixth and below combined for around 10%. By region, Asian companies from Taiwan, South Korea, and China account for about 90% of the total. (This situation remained unchanged by the end of 2024.)

From top to bottom, the top five are TSMC (Taiwan), Samsung (South Korea), UMC (Taiwan), GlobalFoundries (U.S.), and SMIC (China). The fifth and sixth places are far apart, so these rankings are expected to remain the same for the time being. All but Samsung are pure-play foundries. (Although the rankings from third to fifth place were shifting because their market shares were close to each other, the rest of the situation remained unchanged even at the end of 2024.)

As I mentioned in Volume 13, GlobalFoundries was originally the manufacturing division of AMD (U.S.), but became an independent foundry after separating in 2009.

Although the top five companies account for more than 90% of the market, an analysis of the contents reveals that TSMC dominates with a share of over 50%. TSMC is in first place, and Samsung is in second place, together holding about 70% of the market. The shares of the third through fifth places are all less than 10%. (By the end of 2024, TSMC’s share had grown into the upper 60% range, and when combined with Samsung’s, they held around 75% of the market.)

As I discussed in Volume 5, TSMC and Samsung were the only survivors as of 2022 when limited to the most advanced wafer processes. (The situation remained the same at the end of April 2025.)

The business structure is such that a small number of foundries support a large number of fabless companies.

In 2021, Intel announced plans to strengthen its foundry business. If all goes well, Intel will become a leading fine process foundry alongside TSMC and Samsung. In February 2022, Intel announced its plan to acquire Tower Semiconductor (hereinafter referred to as Tower), one of the top 10 foundries in Israel in terms of revenue. Once the acquisition is complete and Tower is integrated into Intel’s foundry business, Intel will rank seventh or eighth among the top 10 foundries.

Note: In August 2023, Intel announced its decision to abandon the Tower acquisition. Therefore, the above-mentioned “Once the acquisition is complete and Tower is integrated into Intel’s foundry business, Intel will rank seventh or eighth among the top 10 foundries.” did not come to fruition. Despite the acquisition not being completed, Intel and Tower continue to work together. In September 2024, Intel announced that it would spin off its foundry business as an independent subsidiary. However, as of the end of April 2025, the conversion has not yet occurred.

The following table summarizes the events presented thus far, including those from the previous volume.

| Year | Fabless Companies | Foundries |

| 1965 | Proposition of Moore's Law (U.S.) | |

| 1969 | Foundation of LSI Computer Systems Inc. (US) | |

| 1973 | Foundation of ITRI (Taiwan) | |

| 1974 | Foundation of ERSO in ITRI (Taiwan) | |

| 1979 | Professor Mead’s advocacy of “separation of design from manufacturing” (U.S.). | |

| 1980 | Foundation of UMC (Taiwan) Note: At this time as IDM |

|

| Publication of Introduction to VLSI Systems by Mead and Conway (U.S.) | ||

| 1981 | Mead and Conway receive Electronics Magazine’s Achievement Award. (U.S.) | |

| 1983 | Foundation of Altera (U.S.) | |

| 1984 | Foundation of C&T, Xilinx, and Cirrus Logic (U.S.) | |

| 1985 | Foundation of Qualcomm (U.S.) | ITRI Taiwan appointed Morris Chang as its president. (Taiwan) |

| 1987 | Foundation of TSMC, a pure-play foundry company (Taiwan) | |

| 1991 | Foundation of Broadcom (U.S.) | |

| 1993 | Foundation of NVIDIA (U.S.) | |

| 1994 | Foundation of the Fabless Semiconductor Association (FSA) | |

| 1995 | UMC changed its business model from IDM to a pure-play foundry. (Taiwan) | |

| 1997 | Foundation of MediaTek (Taiwan) | |

| 2007 | FSA was reorganized into the Global Semiconductor Alliance (GSA). | |

| 2009 | AMD changed its business model to a fabless company. (U.S.) | Foundation of GlobalFoundries (U.S.) |

| 2021 | Intel announced the strengthening of its foundry business. (U.S.) | |

| 2022 | Intel announced the acquisition of Tower. (U.S.) | |

| Professor Emeritus Mead received the Kyoto Prize. | ||

| 2023 | Intel announced the termination of the Tower acquisition. | |

| 2024 | Intel announced that it will spin off its foundry business into a subsidiary. | |

In this volume, I discussed foundries, which are companies that specialize in front-end manufacturing. I had planned to conclude my discussion of horizontal specialization in this third volume of this series. However, the topic expanded as I wrote it, and it could not be contained within three volumes. Therefore, I will cover additional topics related to horizontal specialization in the fourth volume, which will conclude this series.

Click below to read this series.

Semiconductor Miniaturization:

Volume 1: Semiconductor Miniaturization: What is Moore’s Law?

Volume 2: Semiconductor Miniaturization and Manufacturing Process

Volume 3: Semiconductor Miniaturization and International Technology Roadmap

Volume 4: Semiconductor Miniaturization and Semiconductor Business

Volume 5: Semiconductor Miniaturization and Semiconductor Business (Part 2)

Volume 6: Semiconductor Miniaturization and Semiconductor Devices

Volume 7: Semiconductor Miniaturization: What is MOSFET Scaling?

Volume 8: Semiconductor Miniaturization: Limitations of MOSFET Scaling

Volume 9: Semiconductor Miniaturization and Analog Circuits

Shift to Larger Diameter Silicon Wafers:

Volume 10: Shift to Larger Diameter Silicon Wafers: How a Common Material, Silicon, Became a Main Player

Volume 11: Shift to Larger Diameter Silicon Wafers (Part 2): How Silicon Wafers Are Made

Volume 12: Shift to Larger Diameter Silicon Wafers (Part 3): Reasons and History

Horizontal Specialization in the Semiconductor Industry

Volume 13: Horizontal Specialization in the Semiconductor Industry and the Rise of Fabless Companies

Volume 14: History of Horizontal Specialization in the Semiconductor Industry–Emergence of Fabless Semiconductor Companies

Volume 15: History of Horizontal Specialization in the Semiconductor Industry–Emergence of Foundries

Comment